We are looking good recovery in UPL in last two trading sessions

Long if Prices manage above 400 level

417 …… 430 on cards

We are looking good recovery in UPL in last two trading sessions

Long if Prices manage above 400 level

417 …… 430 on cards

We are looking at 26507 level above closes on Current Gold chart

Above that Gold ready for blast…. non stop rally begin upto 27575 & more……

What will be happened ????, do not know but its a again good time for Gold bulls to add more lots

With Best Risk (Stop -loss ?? ) – Reward (almost 1000 points) point of view.

………….. We are here to Trained you …………

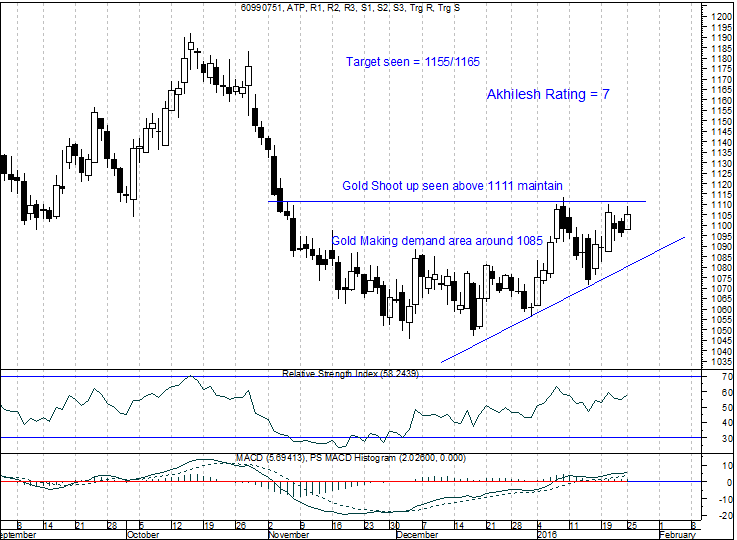

Gold Demand zone 1085-1110 …..

1111 above 2-3 closes may push gold upto 1155 then 1165

Can you take decisions by reading Technical Charts ? (Its work – Help to manage Risk)

————-Its all for Education point of you————

If you do not have basic education about financial markets Trading/Investing think today and opt

” We strongly believe No one tip provider in the world make you rich only your determination, Experience levels make this happen”

USDINR may continue its rally……….

We are looking for more depreciation …

If USDINR manage to maintain above 68.05

69.55 ….. and more on cards

( An investor must know about Dollar or better domestic currency movement to take decision for any asset class trade viz Equity, Commodities or else)

If you understand you are on the right path, Rest you have to educate yourself to understand about inter markets relationship.

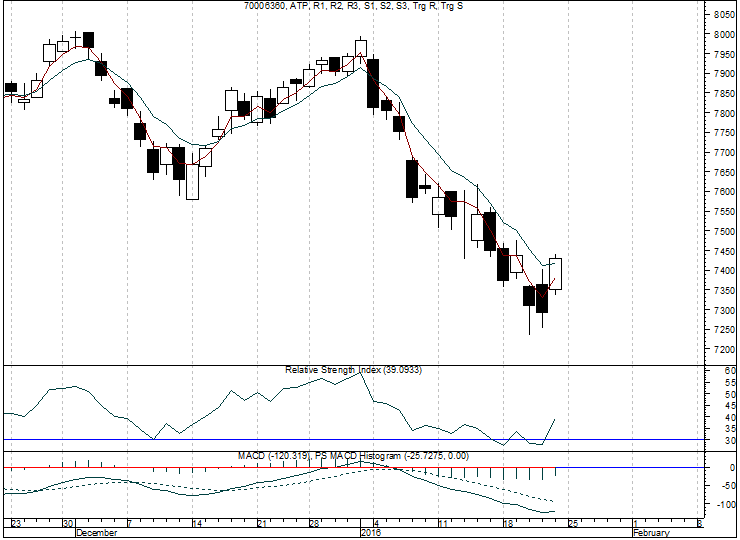

Nifty Future attained 7475 level as we told you…..

But we are looking for 7475 closing for shoot up rallies

Below that Prices may sandwiched between 7400-7475……..

Further panic seen only below 7400 (Make or Break point) 1-2 closings …..

Targets 7250 …. then 7075 on Card

….. So trade Bullish or Bearish here …..

For That Trained yourself for market dynamics

Short Term Trend Deciders:

BHEL maintain above …… 148.25 few mins ….. 152 …… 168 on Cards

LIC Housing Finance ……..486 …….. can test 505 and more

HDFC Worst over ………..1158 ……. 1175/1230 +++

Yes Bank above ———- 687 ——— Looking for 702/710 +++

Buy Lupin Labs at lower levels until not maintain 1695 (Key Support Panic only below this)

Sharp shoot up seen above 1740 (Add more) ….

Short term target seen 1805 +++++ and more

………………..Technical Charts say everything ……….

Understand Risk Management Practices and read about trading psychology makes you different from others

………………….Learn it, It works a lot………………..

Last week witnessed sharp recovery in crude form lower levels

We are still long in crude for immediate short term

———— 2145 Watchable ………….

2-3 closes above this push crude upto 2290… then 2490+++ very soon

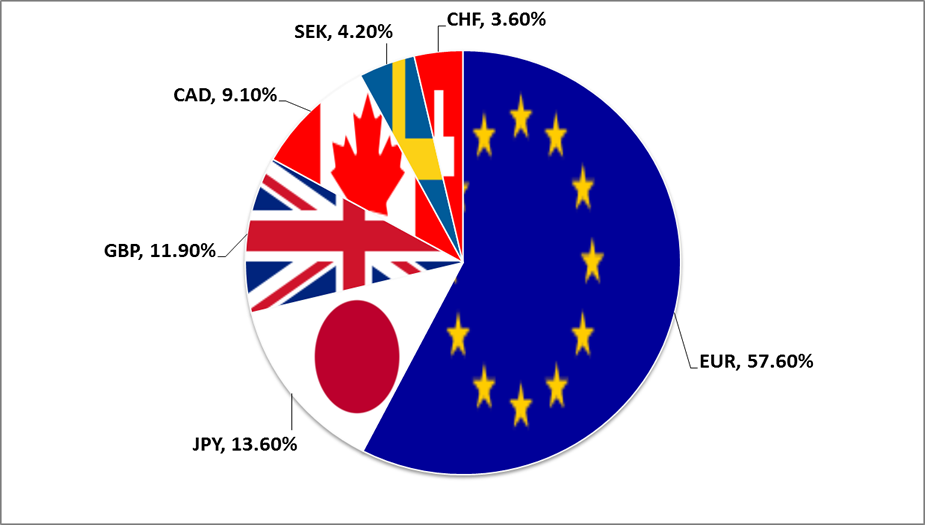

Dollar Index is the key index watchable for all traders.

On Technical point of view

Bulls and bear share equal field of playing

Short term trend side ways

Positional Dollar Index in Bullish phase

Where 100.40/101.25 key levels to watch closing basis

Only professionals understand Importance of closing basis.

Before enter in financial market trading

Get Trained Yourself.

Technically Yours,

Team Technical IQ

Jaipur

As per our Technical view Nifty completed its short term Technical cycle

And provide close above 7410 last week, Very promising for bulls

If Nifty manage to trade above 7410 in near term

We are looking at 7475 then non stop run up upto 7755 on charts

TMC Next worst finished for near term

If TMC prices manage above 8525

We go for long

for our ultimate positional short term target 9400 ++++

Where will be the stops ???????

Educate your self for Risk Management (Stop-loss)practices

The only thing we can control in markets is Loss, not Profit

Work on it !!!!!!

www.technicaliq.com, markets view is purely based on general guidelines of Technical Analysis. As markets are very dynamic by nature, so forecasting of markets is subject of probabilities not certainties. Before you get started with trading in the financial markets, you should consider your trading and investment goals, objectives, trading experience and your personal risk tolerance.We do believe subscribers/viewers acting on these recommendations or views after assuming all the risk involved then reach to actual judgment for buy or sell. Our site will never ever create any intention for bad information. This is only for your information and guidance. For more information visit: