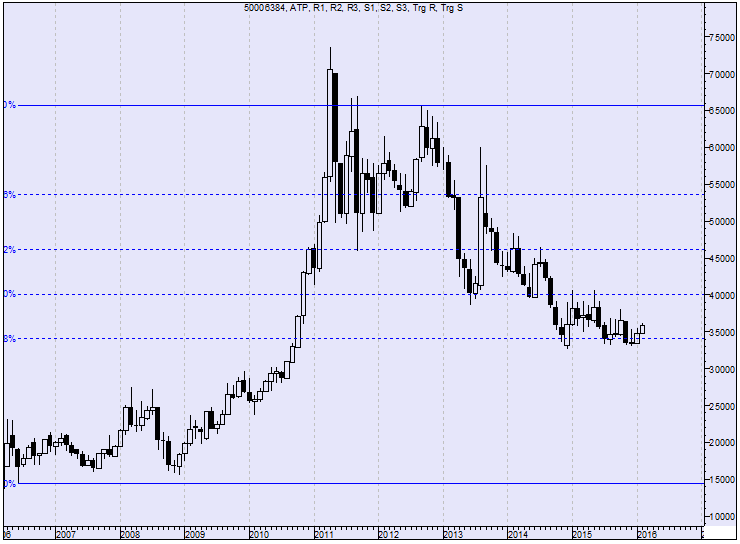

A chart reader knows all, you might be even do not understand yet:

Ask yourself –

1. Do I know/capable all Fundamentals/Economic conditions responsible for gold rally in last few weeks and If yes (Might be in case of 1-2 % Investors only) ….. Do you believe you are one of them …. Bis question mark ????

If Yes:

a. Did I know the Entry points ?

b. Do I know the predefined exit area ?

2. Do i know this trade is fesible according to my caital ?

3. Do I know where is the (Stoplosses) and can categories like this: Initial stoploss/Break Even Stoploss /n Profit Stoploss for me ?

4. Did you enter in the trade and exit after earn few pennies and then rally ignite ???

and many more questions/problems do you face in your trading career yet.

To overcome all these obstacle trained yourself. Because no one know only single decision/view can change yours fortune.

Best of Luck.