Go short on rise….

Key Technical resistance shifted to 7055.50 from 7363.

Nifty Spot LOC 7055.50

![]()

Nifty Spot LOC 7055.50

Immediate short term positional targets are:

To know more Trained yourself.

Go short on rise….

Key Technical resistance shifted to 7055.50 from 7363.

Nifty Spot LOC 7055.50

![]()

Nifty Spot LOC 7055.50

Immediate short term positional targets are:

To know more Trained yourself.

We recommend you to sell Bank Nifty below 14750…. for first target of 14000 below.

See the real bloodbath..

Now 13900 is the last hope closing basis

Now 13900 is the last hope closing basis

Below that….

Follow us for updates.

Now We stand aside and see Market behavior between 7043-7090.

Key support area… Big panic only below this after 2-3 closes.

Either we look for buy or wait for next clue from here.

6682 Below 7043-7090(Mid) Above 7675

To know more LEARN LEARN n LEARN.

Technically Yours,

Team Technical IQ,

Jaipur.

For Day Trading Nifty Supply Zone Intact 7289 – 7307 (Intraday LOC)

Keep selling Nifty if Price maintain below 7233.80

Looking for 7088 target.

Technically Yours,

Team Technical IQ,

Jaipur.

What we said as expected gap down open —— Targets 7208.80 …… 7088.80

And Our LOC for today was 7289

Check the pull back high yes its 7287.95

then 60 points fall in Just 30 mins.

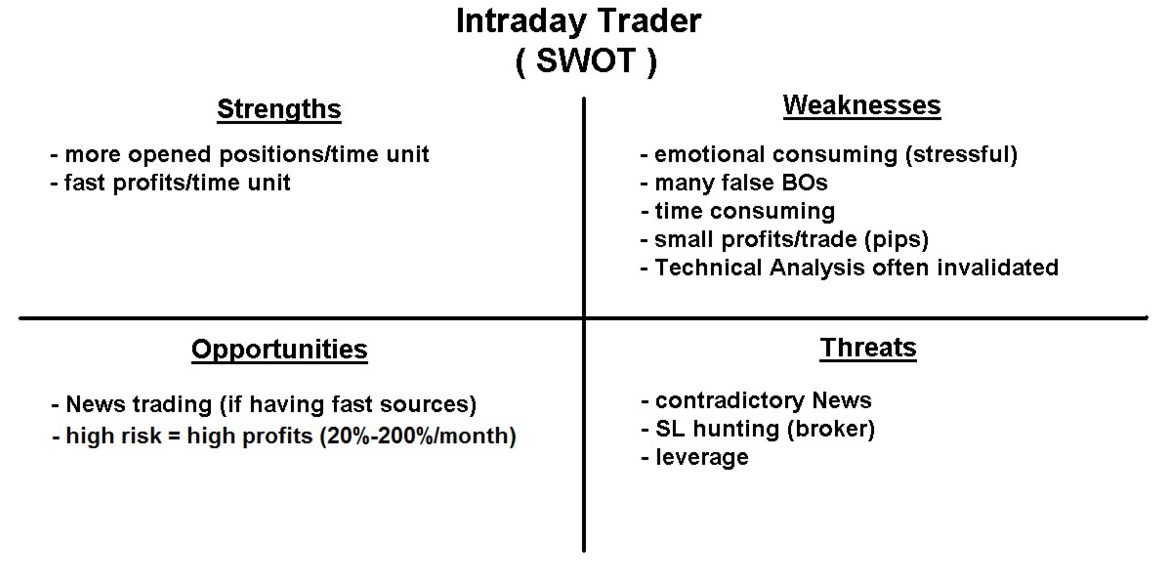

We are positional traders. and

How a positional trader use this information ???? Learn it.

Only positional traders understand bcz

They Buy/Sell like a trader but hold like an Investor.

Did you miss me.

Sell Auro Pharma on rise. SR 784 and 797. Target = 691.75 / 645.75/599.75

Result day.

— Akhilesh Jain (@Jainisakhilesh) February 9, 2016

Day traders fail sooner or later in this dynamic trading world and out from the markets finally.

Follow us ………………. We are positional trader.

We turned bearish in Nifty for short term.

and looking 7450 its LoC.

Seems market open gap down as expected & For Intraday traders 7289 will be key supply zone.

Targets intact 7208.80…….. then penic fall upto 7088.80 (Solid Support closing basis for Indian markets)

For Bank Nifty 14750 is rock support. If breached and maintained few minutes sharp panic for Intraday

14445/14000 on cards.

Finger crossed.

Nifty seems in Bear Grip for short term below 7450.

Do not start buy until not close above this level.

Sell in range of 7420-7435

wait for lower levels.

On charts Nifty struggle to maintain on upper levels.

and again n again test its LoC (Line of control) i.e. 7450

Before any further development we use minus button below 7450 targeting previous low then 7080.

and above that market may retraced upto 7685.

Means:

7685 (Upper range)

7450 (LoC)

7080 (Lower support)

Markets are subject of probability not certainty – Understand risk.

Go Long on Sadbhav Eng. above 315.05 or also in dips until stock not close below 209.80.

Your market watch may display soon

327.80 and more n more

Trained market viewer is the gainer these days in markets.

www.technicaliq.com, markets view is purely based on general guidelines of Technical Analysis. As markets are very dynamic by nature, so forecasting of markets is subject of probabilities not certainties. Before you get started with trading in the financial markets, you should consider your trading and investment goals, objectives, trading experience and your personal risk tolerance.We do believe subscribers/viewers acting on these recommendations or views after assuming all the risk involved then reach to actual judgment for buy or sell. Our site will never ever create any intention for bad information. This is only for your information and guidance. For more information visit: